The Crypto market has become very popular in recent years, attracting many people, including investors, traders, and technology lovers. It is a digital marketplace where people buy, sell, and trade different types of digital money, known as cryptocurrencies. Some of the most well-known cryptocurrencies are Bitcoin and Ethereum, but there are thousands of others.

One of the biggest differences between the crypto market and traditional stock markets is that it never closes. You can trade cryptocurrencies 24 hours a day, 7 days a week. Also, no single company, government, or bank controls the crypto market. Instead, it runs on a technology called blockchain, which keeps all transactions secure and transparent.

If you are new to the crypto market, getting started may seem confusing, but it can be simple if you follow a few steps. First, you need to choose a cryptocurrency exchange, which is a platform where you can buy and sell cryptocurrencies. Next, you create an account, deposit money, and start buying digital coins. It is important to learn about different cryptocurrencies, how prices change, and the risks involved.

By understanding how the crypto market works, you can make better decisions and explore its opportunities safely.

Table of Contents

Cryptocurrency is a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit or double-spend. Examples include Bitcoin, Ethereum, and Litecoin.

What is the Crypto Market?

The crypto market is a place where people buy, sell, and trade digital money like Bitcoin and Ethereum. Unlike the stock market, it never closes and is not controlled by any government or bank.

Cryptocurrencies are digital assets secured by blockchain technology, which ensures transparency, immutability, and security. The market consists of various participants, including retail investors, institutional investors, miners, and developers.

How Does the Crypto Market Work?

1.Decentralization:

Cryptocurrencies operate on a decentralized blockchain network, meaning no single entity controls the system. Transactions are verified by a distributed network of computers (nodes).

2.Supply and Demand:

The prices of cryptocurrencies are determined by supply and demand. If demand for a particular cryptocurrency increases, its price rises, and vice versa.

3.Exchanges:

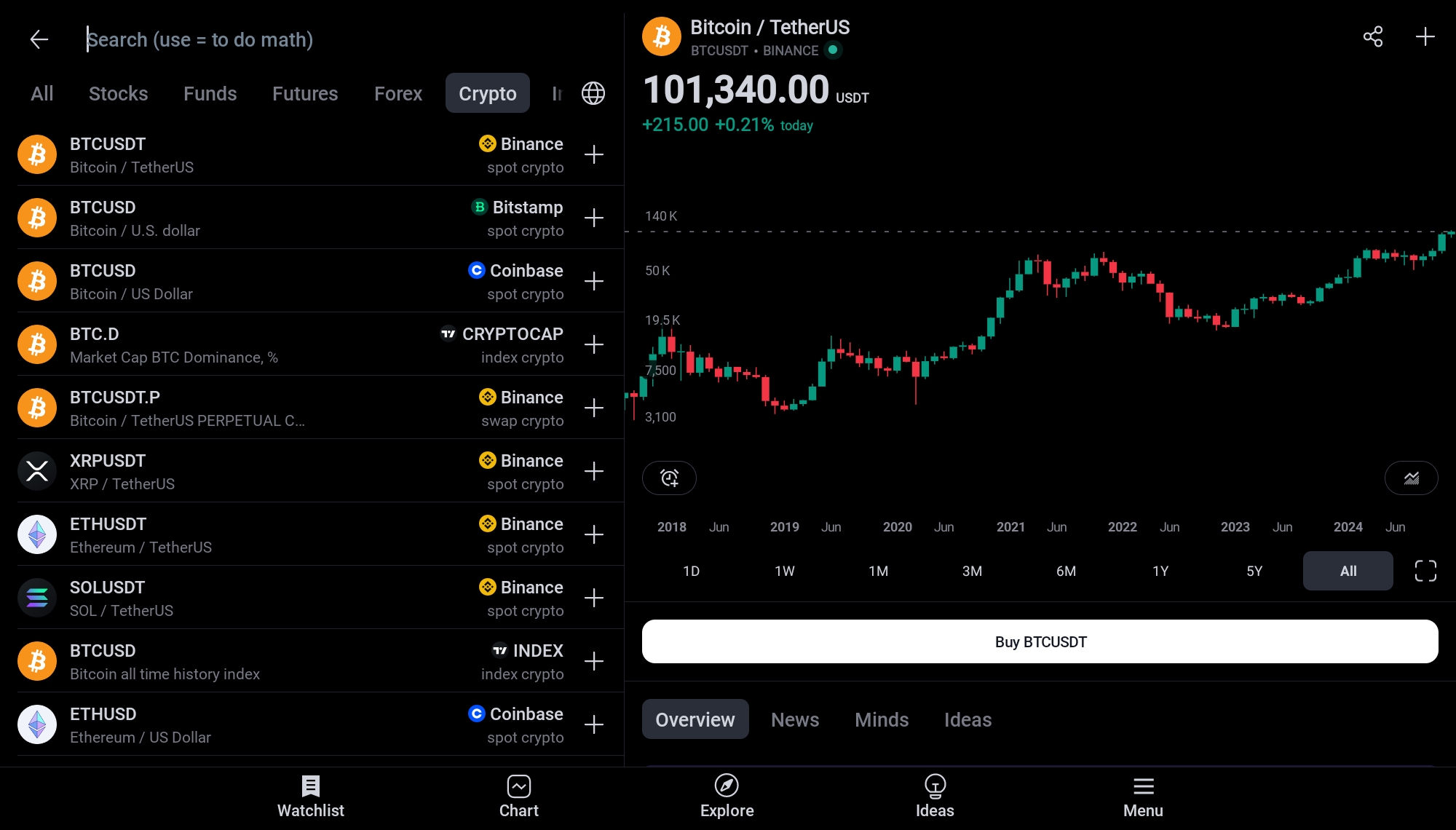

Crypto exchanges are platforms where users can trade cryptocurrencies. Popular exchanges include Binance, Coinbase, Kraken, and others. They act as intermediaries, facilitating transactions between buyers and sellers.

4.Wallets:

Cryptocurrency wallets are digital tools used to store, send, and receive cryptocurrencies. There are two main types of wallets:

- Hot Wallets: Connected to the internet (e.g., mobile apps, web wallets).

- Cold Wallets: Offline wallets (e.g., hardware wallets) for enhanced security.

5.Blockchain Technology:

Transactions are recorded on a blockchain, a distributed ledger that is secure and transparent. Every transaction is verified and added to the blockchain by miners or validators.

How to Start in the Crypto Market: Step-by-Step Guide.

The world of digital finance is changing, and trading cryptocurrency has become an attractive investment option for many. This guide will outline the basic steps to help you start trading cryptocurrencies successfully and with confidence.

Step 1: Research and Education:-

Before investing, learn about cryptocurrencies, blockchain technology, and the risks involved. Familiarize yourself with common terms like wallets, private keys, exchanges, and trading pairs.

Step 2: Choose a Reliable Exchange:-

Select a trusted cryptocurrency exchange to buy and trade digital assets. Some popular options include:

- Binance

- coin CDX

- delta exchange

- coinbase

Create an account on your chosen platform and complete the required KYC (Know Your Customer) verification process.

Step 3: Secure a Wallet:-

Set up a cryptocurrency wallet to store your assets securely. Use a hot wallet for frequent transactions and a cold wallet for long-term storage.

Step 4: Buy Cryptocurrency:-

Deposit fiat currency (like USD, INR, or EUR) into your exchange account. Then, buy cryptocurrencies like Bitcoin, Ethereum, or others based on your research.

Step 5: Diversify Your Portfolio:-

Avoid putting all your money into a single cryptocurrency. Diversify your investments across different coins to reduce risk.

Step 6: Learn Trading Strategies:-

Understand the basics of crypto trading:

Spot Trading: Buying and selling at the current market price.

Futures Trading: Speculating on the future price of a cryptocurrency.

Staking: Earning rewards by holding and supporting a blockchain network.

Step 7: Monitor and Stay Updated:-

Track the market trends and news regularly. Use tools like CoinMarketCap or CoinGecko to monitor cryptocurrency prices and market data.

Benefits of the Crypto Market:

- Volatility: Prices can fluctuate dramatically.

- Regulatory Issues: Cryptocurrencies are not regulated in many countries.

- Security Risks: Hacking and scams are prevalent in the crypto space.

Conclusion

The crypto market is a revolutionary space that offers exciting opportunities for investors and traders. However, it is essential to approach it with caution and thorough research. By following the steps outlined above, you can begin your journey in the crypto world while minimizing risks. Always remember to invest only what you can afford to lose and stay updated with market trends.

What is blockchain technology?

Blockchain is a decentralized ledger that records all cryptocurrency transactions in a secure and transparent manner. It is the foundation of cryptocurrencies like Bitcoin.

How do I choose a cryptocurrency to invest in?

Research factors like the project’s purpose, team, technology, market capitalization, and historical performance. Diversify your investments to manage risk.

How is cryptocurrency different from traditional money?

Unlike traditional currencies issued by governments, cryptocurrencies are decentralized, not controlled by any central authority, and rely on blockchain technology for security and transparency.

https://zigjack.com/best-crypto-to-buy-now-2025-cryptocurrency-investment/